Snapshot: Where the Macro Stands Now

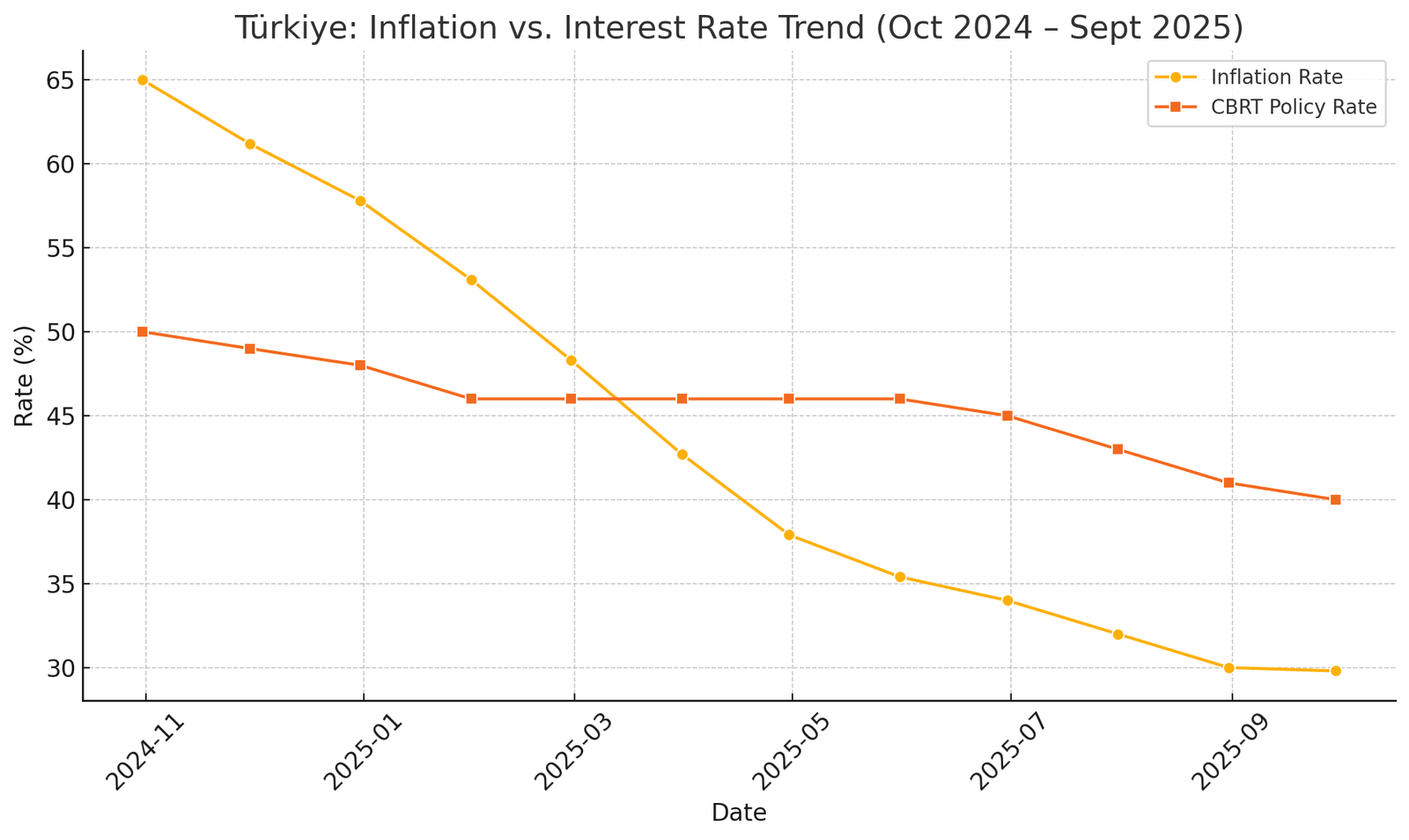

- Inflation keeps easing. May CPI cooled to 35.41 % y/y, the lowest since late-2021 and well below April’s 37.86 % print reuters.com.

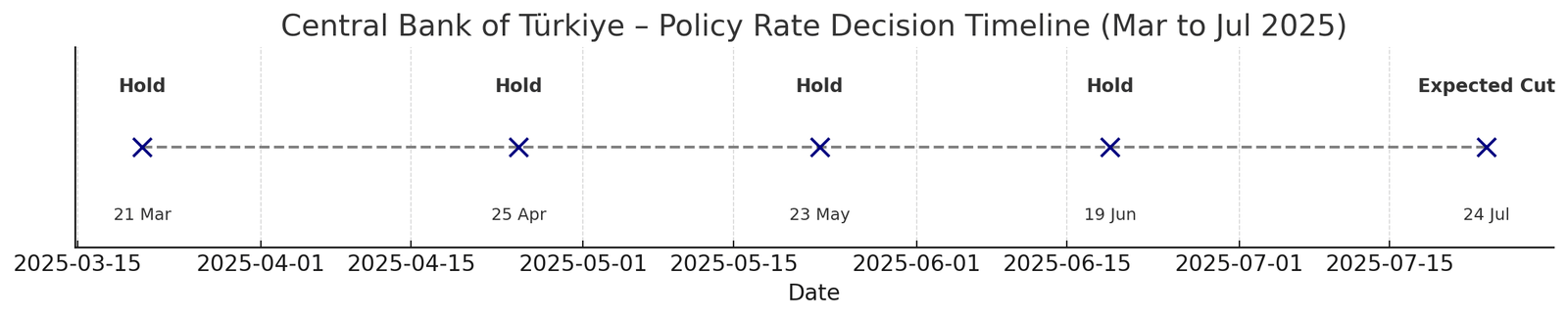

- Policy on pause—cut in sight. On 19 June the CBRT held its one-week repo at 46 %, but its statement hinted the door is open to cuts once the disinflation trend is “firmly established.” Markets and economists now put high odds on a first cut at the 24 July MPC meeting reuters.comcapitaleconomics.com.

- Forward expectations keep falling. The CBRT’s June Survey of Market Participants projects CPI at 29.9 % by end-2025 (vs. 30.4 % a month ago) and sees the policy rate dropping to ≈40 % by September and ≈36 % by year-end dailysabah.com.

- Investor sentiment is thawing. Turkish bank shares have rallied on cheaper-funding hopes, and local bonds have attracted fresh inflows since January reuters.comreuters.com.

📉 Cooling Inflation Opens Door for Monetary Easing

Inflation in Türkiye, while still elevated, has shown encouraging signs of moderation. Annual consumer price inflation dropped to 35.41% in May, down from 37.86% in April, with monthly inflation at just 1.53%—notably lower than expectations dailysabah.com

The central bank’s Survey of Market Participants (June) indicates optimism: inflation is projected to fall to 29.86% by the end of 2025, with a 12-month outlook pointing to 24.56% dailysabah.com

🔒 Central Bank Maintains High Rates, Signals Patience

On June 19, the CBRT held the one-week repo rate at 46% and the upper band at 49%, citing ongoing inflation decline and slower domestic demand dailysabah.com

Officials emphasized that tight monetary policy remains in place until inflation shows a sustained downward trend paturkey.com

🔮 Why July Is the Anticipated Turn

Market responses and statements hint that July 2025 could mark the beginning of rate reductions:

- The CBRT recently dropped tightening bias, removing language that signaled further rate hikes and instead opening the possibility that rate cuts may commence in July dailysabah.com

- The RBI’s survey forecasts a 3 percentage point cut by September, likely initiated in July dailysabah.com

- Analysts at S&P Global and Bloomberg noted a shift in tone, suggesting that markets are preparing for a rate-cut cycle reuters.com.

📅 Timeline Snapshot

| Date | Event |

|---|---|

| May–June 2025 | Inflation slows (35.41% YoY, down from 37.86%) dailysabah.com |

| June 19, 2025 | CBRT holds policy rate at 46%, upper band at 49%, maintains tight stance |

| June Survey | Market expects July rate cut and year-end inflation around 29.86% |

| July 24, 2025 | Next CBRT meeting—widely expected to begin easing |

Why a July Cut Matters for Property Buyers

| Impact Channel | What Changes if CBRT Cuts in July? | Why It Matters for Real Estate |

|---|---|---|

| Mortgage & Developer Finance | Lira lending rates would start edging lower (albeit from very high levels). | Lower monthly payments widen the domestic buyer pool; developers restart delayed projects. |

| Valuations & Price Momentum | Cheaper credit typically boosts demand 3-6 months later, pushing prices up—especially where supply is tight (central Istanbul, Bosphorus view, select coastal villas). | Buying before the rate-cut cycle can lock in discounts and early-cycle appreciation. |

| Currency & Return Calculus | A credible easing path can steady the lira by anchoring inflation expectations; bond yields already slid toward 31 % in mid-June (10-yr benchmark)investing.com. | Stabilised FX plus 7-9 % USD yields on prime Istanbul rentals raises the real (inflation-adjusted) return profile. |

| Foreign Capital Flows | Lower rates + disinflation invite larger EM-debt allocations; foreign holdings of lira bonds have risen to > 10 % of the marketreuters.com. | A stronger bid for Turkish assets usually spills into trophy real estate segments, lifting exit prices for early movers. |

⚠️ Risks and Conditions to Watch

- Sticky Services Inflation: While food inflation eased, services prices—especially housing and education—remain high reuters.com

- External Shocks: Geopolitical tensions or commodity price spikes could undermine progress .

- Coordinated Policy: Effective disinflation will depend on tight monetary-fiscal coordination and stable administered prices tcmb.gov.tr.

Strategic Takeaways for Investors

- Front-load due diligence now. Good stock moves fast once financing loosens; lock in reservations before July’s MPC.

- Blend lira and FX hedges. Consider lira-denominated purchases for price upside, paired with USD-linked rental contracts or swaps.

- Prioritise yield-ready assets. With nominal mortgage rates still high, cash-flowing units offset carry costs while valuations catch up.

- Stay data-driven. Track CPI momentum and CBRT communication each month—Urban Invests will brief clients straight after every release.

✅ Bottom Line

Markets are currently anticipating Türkiye’s first interest rate cut in July 2025, driven by a meaningful slowdown in inflation, improved communication from the CBRT, and supportive forecasts. However, this remains contingent on sustained disinflation and geopolitical stability.

🧾 Sources

- Daily Sabah, “Markets price in July rate cut as Türkiye inflation outlook improves,” 16 Jun 2025 dailysabah.com

- Reuters, “Turkey inflation dips more than expected to near 35 % in May,” 3 Jun 2025 reuters.com

- Reuters, “Turkish central bank holds all rates steady, maintains tight policy,” 19 Jun 2025 reuters.com

- Capital Economics Rapid Response, “Turkey Interest Rate Announcement (June 2025),” 19 Jun 2025 capitaleconomics.com

- Investing.com, Turkey 10-Year Government Bond Yield data, 18–19 Jun 2025 investing.com

- Reuters, “Foreign investors bet on Turkey, drawn by rate cuts, easing inflation,” 24 Jan 2025 reuters.com

- Central bank’s revised guidance paturkey.com