Tax Implications for Turkish Real Estate Investments in 2024 - Updated Guide

Investing in Turkish real estate can be a lucrative opportunity, especially with its favorable tax system compared to many other countries. Whether you’re buying property for personal use or as an investment, understanding the tax landscape in Turkey is crucial for optimizing your returns and compliance. Here’s an updated guide to help you navigate the tax implications of owning and earning from Turkish real estate in 2024.

Tax Residency and Income Tax in Turkey

Your income tax liability in Turkey depends on whether you are classified as a resident or non-resident for tax purposes:

Resident Taxpayers:

- A foreign national is considered a tax resident if they live in Turkey for more than six months within a calendar year or hold a valid Turkish residence permit.

- Residents are taxed on their global income, including income from property or other sources outside Turkey.

Non-Resident Taxpayers:

- Non-residents are taxed only on income earned within Turkey, such as profits from real estate sales or rental income.

- Most foreign property owners fall into this category, especially those using Turkish properties as vacation homes or investments.

Taxes on Real Estate in Turkey: Key Points to Know

Taxes on Turkish real estate fall into three main categories:

1. Stamp Duty on Property Transfers

- Rate: 4% of the declared property value, typically split between buyer and seller but often negotiated as the buyer’s responsibility.

- Declared Value: Often lower than the actual purchase price, but it must meet a minimum threshold to avoid challenges from Turkish tax authorities.

- Pro Tip: Ensure the declared value aligns with market norms (50–60% of the actual value) to avoid audits.

2. Annual Property Tax

- Rate: Ranges between 0.1% and 0.3% of the property’s assessed value, depending on location and type (residential or commercial).

- This tax is comparable to council taxes in the UK or US but significantly lower in monetary terms.

3. Income Tax on Real Estate Earnings

- Rental Income:

- Taxed after deducting expenses such as maintenance and repairs.

- Tax brackets range from 15% to 40%, with annual exemptions for small income amounts.

- Capital Gains Tax:

- Applied to profits from selling a property within five years of purchase.

- The tax is calculated based on the difference between the purchase price and the declared sale value.

- Exemption: No capital gains tax is due if the property is held for more than five years.

How Turkey’s Real Estate Taxes Compare Globally

Turkey offers one of the most investor-friendly tax environments compared to other countries:

- Russia: Foreign investors face 30% income tax on rental income with no deductions.

- France: Differentiates between furnished and unfurnished rentals, taxing “professional” landlords heavily.

- Italy: Rental income is taxed at 23–43%, and global income is taxed for residents.

- Switzerland: Boasts one of the highest tax rates, with 54.5% applied to rental income.

- Turkey: Offers significantly lower property taxes, No capital gains tax after five years, and fewer restrictions on foreign property ownership.

Why Turkey is a Top Choice for Real Estate Investors

Favorable Tax Rates:

- Lower taxes compared to other popular real estate markets.

- Exemptions on capital gains after five years of ownership.

Ease of Ownership:

- Minimal barriers for foreigners, including legal protections for property owners.

High Growth Potential:

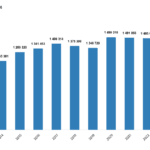

- Real estate prices in Turkey have shown robust growth, offering excellent ROI.

Strategic Location:

- Positioned between Europe and Asia, Turkey is a global hub for business and travel.

Important Considerations for Investors

- Declared Values: Avoid declaring unrealistically low property values to save on taxes; this can trigger audits or penalties.

- Legal Advice: Always seek professional advice before completing a property transaction to ensure compliance.

- Tax Planning: Work with a tax consultant to maximize deductions and exemptions, especially if you plan to rent or sell your property.

Conclusion: A Smart Investment in 2024

With its competitive tax system, favorable exemptions, and high growth potential, Turkey remains an attractive destination for real estate investors. Whether you’re looking for a vacation home, a rental property, or a long-term investment, the Turkish market offers unique advantages.

Secure 50% off Your Turkish Citizenship Today

With its affordability, ease of process, and strategic benefits, Turkey’s citizenship-by-investment program is a gateway to endless opportunities. Whether you’re an investor, a global nomad, or someone seeking a better lifestyle for your family, this program is your answer.

📞 Contact us today to explore pre-approved properties and start your journey toward Turkish citizenship!

ZeytinKule Sea View Apartments in Zeytinburnu

Zeytinburnu, Istanbul, Turkey- Beds: 1 ~ 3

- Garages: 2

- Project, Residential

Büyükçekmece Apartments Near the Sea from $220K

Büyükçekmece, Istanbul, Turkey- Beds: 2 ~ 4

- Garage: 1

- 110 m²

- Project, Residential

Barbarossa Suits – Turn-Key, Short-Stay Residences in the Heart of Beşiktaş

Beşiktaş, Istanbul, Turkey- Beds: Studio, 1BR, 2BR

- Baths: 1~2

- Project, Residential